The Weekly Market Sentiment Report: 31st March - 4th April 2025

The Weekly Market Sentiment Report: 31/03/2025 - 04/04/2025

CONTENTS

EVOLUTION & NATURE OF THE REPORT

ECONOMIC CALENDAR

MARKET SNAPSHOT

UPCOMING PROJECTS

THE COT REPORT STRATEGY

PUT-CALL RATIO SENTIMENT INDEX

THE GAMMA EXPOSURE INDEX

VIX

SECTOR ROTATION GRAPH

THE AAII INVESTOR SENTIMENT SURVEY

THE CRYPTO RSI INDEX

BITCOIN FEAR & GREED INDEX

BITCOIN DOMINANCE CHART

MARKET STRESS INDICATOR 🆕

IMPLIED CORRELATION INDEX

INFLATION RATE MID-TERM MODEL

THE COT REPORT STRATEGY TRACK RECORD

CORRELATION HEATMAP

CLOSED OPPORTUNITIES

DISCLAIMER

EVOLUTION & NATURE OF THE REPORT

New sentiment models are constantly added while taking into account their overall utility. Feel free to leave a feedback (e.g. nature of the document, its usefulness, its time interval, its content, language, etc.). If you want to see more explanatory details on the report, you can refer to the following post:

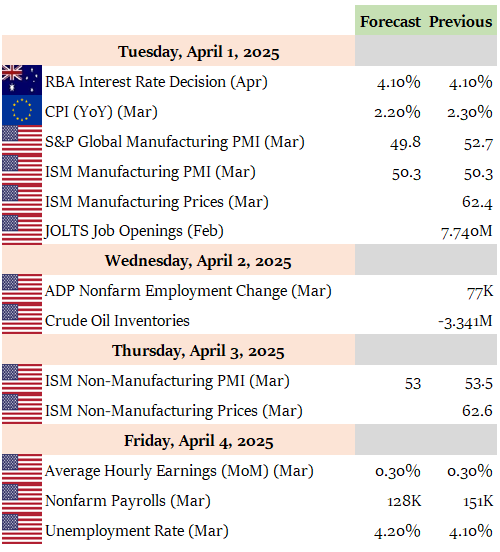

ECONOMIC CALENDAR

An economic calendar is a tool used in finance and economics to track and display upcoming economic events, announcements, and indicators that are relevant to the financial markets and the broader economy. The following shows what to expect for the coming week:

MARKET SNAPSHOT

The below table summarizes the weekly percentage changes of the key markets:

This week, EURUSD moved around -0.43 % while equity markets shaped a -0.27 % move as evidenced by the S&P 500 index. Meanwhile, Bitcoin had a 1.3 % move. The safe haven proxy Gold shaped a 3.31 % move. On the fixed income part, Tnote-10 shaped a 0.11 % move. Lastly, Oil had a performance of 1.11 %.

UPCOMING PROJECTS

The following projects are in-progress and will only be published when security checks are ensured:

💡A new section about individual US stocks: This will feature a number of U.S stocks with a few modern technical indicators and/or patterns in a summarized table/chart.

💡A new section about COT market differentials: This will show objective differentials between different markets, and will serve as an improvement to the original COT report strategy.

💡A new section about seasonality of markets through time: This will feature a type of averaging of a few key markets that will show the expected trajectory for each year. Larry Williams uses this in his reports.

💡A new section about non-linear global correlations: This will improve the correlation heatmap by adding non-linear correlation measures.

Keep reading with a 7-day free trial

Subscribe to The Weekly Market Sentiment Report to keep reading this post and get 7 days of free access to the full post archives.