The Weekly Market Sentiment Report: 30th April - 7th May 2023

The Weekly Market Sentiment Report: 30/04/2023 - 07/05/2023

CONTENTS

EVOLUTION OF THE REPORT

ECONOMIC CALENDAR

THE PUT-CALL RATIO SENTIMENT STRATEGY

THE GAMMA EXPOSURE INDEX (THE WHITE INDEX)

THE AMERICAN ASSOCIATION OF INDIVIDUAL INVESTORS

THE COMMITMENT OF TRADERS REPORT: NORMALIZED VALUES

BITCOIN’S FEAR AND GREED STRATEGY

THE ISM PMI: THE CEO’S SENTIMENT

THE NON-FARM PAYROLLS SIMPLE PREDICTION METHOD

THE UNIVERSITY OF MICHIGAN CONSUMER SENTIMENT INDEX

DISCLAIMER

EVOLUTION OF THE REPORT

This report will grow in time due to feedback and new techniques put into place. You may notice new markets added or other markets removed. Similarly, new techniques and strategies may be added or having their presentation changed so that everyone benefits from this report. Make sure you contact me for your feedback (i.e. nature of the document, its usefulness, its time interval, its content, language, etc.).

At the moment, the future changes over the coming months can be summed up as follows:

Adding the Bullish Percentage Index, a collection of individual technical indicators calculated on each stock of the S&P 500. Following this, a global index is constructed in order to calculate the current sentiment.

Adding the COT Pattern Recognition System: This is a pattern recognition algorithm on the values of the COT.

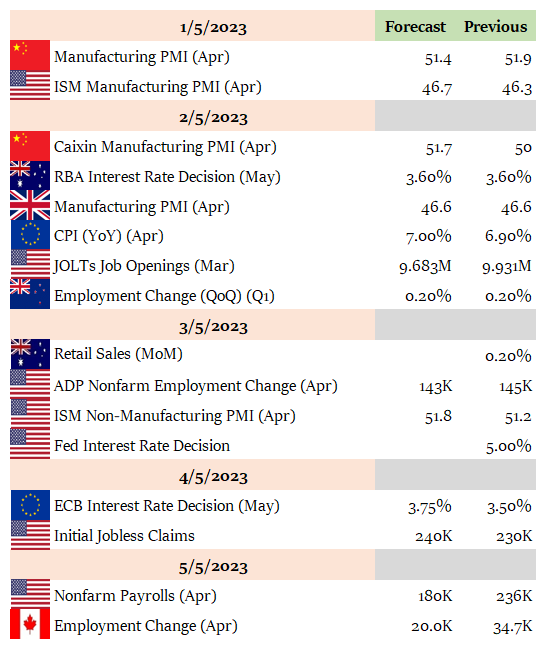

ECONOMIC CALENDAR

THE PUT-CALL RATIO SENTIMENT STRATEGY

The equity put-call ratio published by the CBOE gives insights to the current market stress. Historically, the correlation with the stock market (S&P 500) has been intuitively negative with around -0.40 correlation using the Spearman rank correlation coefficient (with -0.32 correlation given using the Pearson correlation coefficient). Similarly, the maximal information coeffcient (MIC) which measures the degree of non-linear relationship has given 0.20 which suggests there is a relationship between the two time series (whether negative or positive).

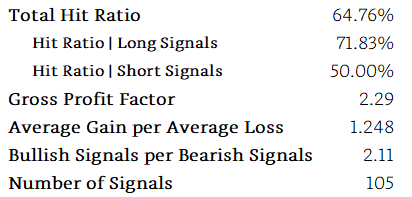

The strategy uses a type of mean-reversion technique on the put-call ratio to derive signals. The performance of the sentiment model is found below.

Conclusion: The sentiment scanner is looking for the next signal since giving a bullish signal a few weeks ago which has seen its potential. Keep in mind that this is a daily indicator.

Historical Performance

THE GAMMA EXPOSURE INDEX (THE WHITE INDEX)

The Gamma Exposure Index (GEI), a proprietary indicator created by financial analytics firm Squeeze Metrics. A stock's or other financial asset's exposure to fluctuations in the general market or benchmark index, usually the S&P 500, is measured by its GEI. The GEI, to put it simply, assesses how sensitive a stock's returns are to fluctuations in the market. A stock's returns are thought to be more closely correlated with market movements if the GEI is higher, whereas the opposite is true if the GEI is lower. Squeeze Metrics employs GEI to shed light on a stock's or portfolio's risk profile and point out potential avenues for diversification or risk management. Historically, the GEI is correlated with the S&P 500 (around 0.30 across all three different correlation metrics).

The strategy uses a type of mean-reversion technique on the put-call ratio to derive signals. The performance of the sentiment model is found below.

Conclusion: According to the GEI’s strategy, the model is looking is showing a bullish signal.

Historical Track Record

THE AMERICAN ASSOCIATION OF INDIVIDUAL INVESTORS

The AAII is an equity-based sentiment indicator published by the American Association of Individual Investors every week. The sentiment strategy combines it with the RSI and a 200-Day moving average. The performance of the sentiment model is found below.

Keep reading with a 7-day free trial

Subscribe to The Weekly Market Sentiment Report to keep reading this post and get 7 days of free access to the full post archives.