The Weekly Market Sentiment Report: 19th March - 26th March 2023

The Weekly Market Update: 19/03/2023 - 26/03/2023

The weekly market sentiment report aims to show directional opportunities from another angle that is different to the mainstream forecasting techniques. It is not supposed to be a trading signals report but merely one that shows what sentiment models are saying.

Every week, key markets are analyzed using a selection of tools, strategies, and patterns developed on a proprietary basis. Refer to the table of contents below for more details. You may use this research as a decision-making aid but never as your sole driver to take on positions.

CONTENTS

EVOLUTION OF THE REPORT

ECONOMIC CALENDAR

THE ARTEMIS INDICATOR

THE WHITE INDEX

THE AAII

THE COT METER

COT PATTERN RECOGNITION

DISCLAIMER

EVOLUTION OF THE REPORT

This report will grow in time due to feedback and new techniques put into place. New techniques and strategies may be added or having their presentation changed so that everyone benefits from this report. Make sure you contact me for your feedback (i.e. nature of the document, its usefulness, its time interval, its content, language, etc.).

The changes implemented so far since the last few weeks are as follows:

Added the economic calendar.

Added the COT pattern recognition and the COT meter system

Grouped the COT meter system into one graph.

At the moment, the future changes over the coming months can be summed up as follows:

A new format will be used as of next week.

Adding much more COT sentiment market data on more markets.

Implementing a VIX strategy.

Implementing an advance decline strategy.

Implementing a candlestick psychological strategy for market sentiment.

ECONOMIC CALENDAR

THE ARTEMIS INDICATOR

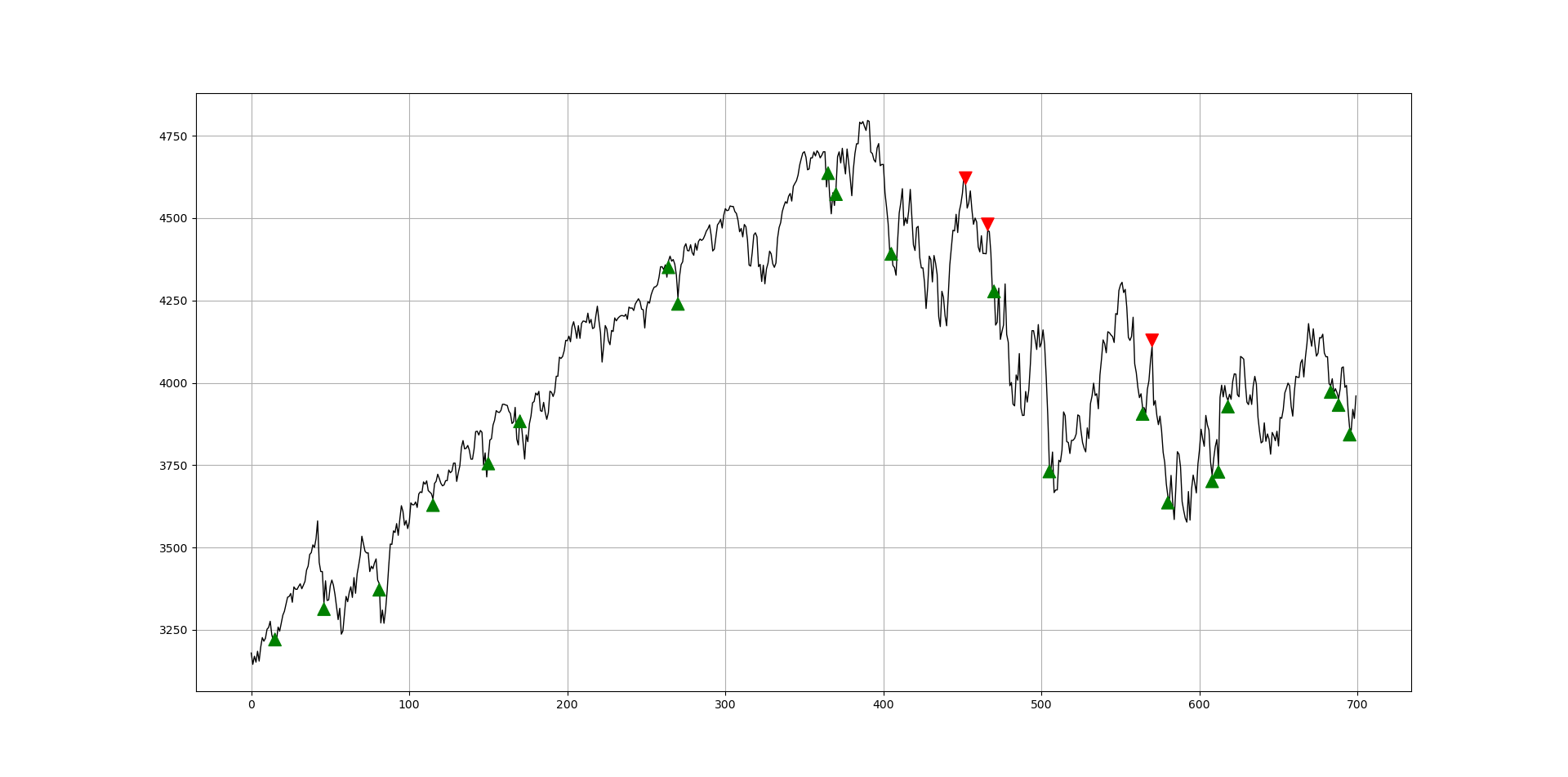

The Artemis Indicator is born out of a transformation of the put-call ratio, a sentiment indicator published by the CBOE which helps with predicting the S&P 500. It is a daily indicator. The following Figure shows the recent signal chart.

Conclusion

Bullish bias remains on the indicator.

THE WHITE INDEX (GEI)

Long-only traders who like to time the dips and follow the upside trend (during a bullish market) should monitor the White Index as it has been specifically designed for this purpose. The following Figure shows the recent signal chart.

Conclusion

Bullish bias remains on the indicator.

Historical Track Record

BITCOIN TACTICAL SENTIMENT INDEX

The Bitcoin Tactical Sentiment Index is a daily sentiment-based indicator which uses insights from volatility, direct surveys, open interest, and patterns to calculate a normalized value that shows where the inflection points are likely to be.

The following Figure shows the recent signal chart.

Conclusion

The model is continuously scanning for a new opportunity. In case a signal is found, an update will be sent to the subscriber. The rare signals on this model may seem frustrating but it is important to know how powerful they are given the back-tests and the live performance.

Historical Track Record

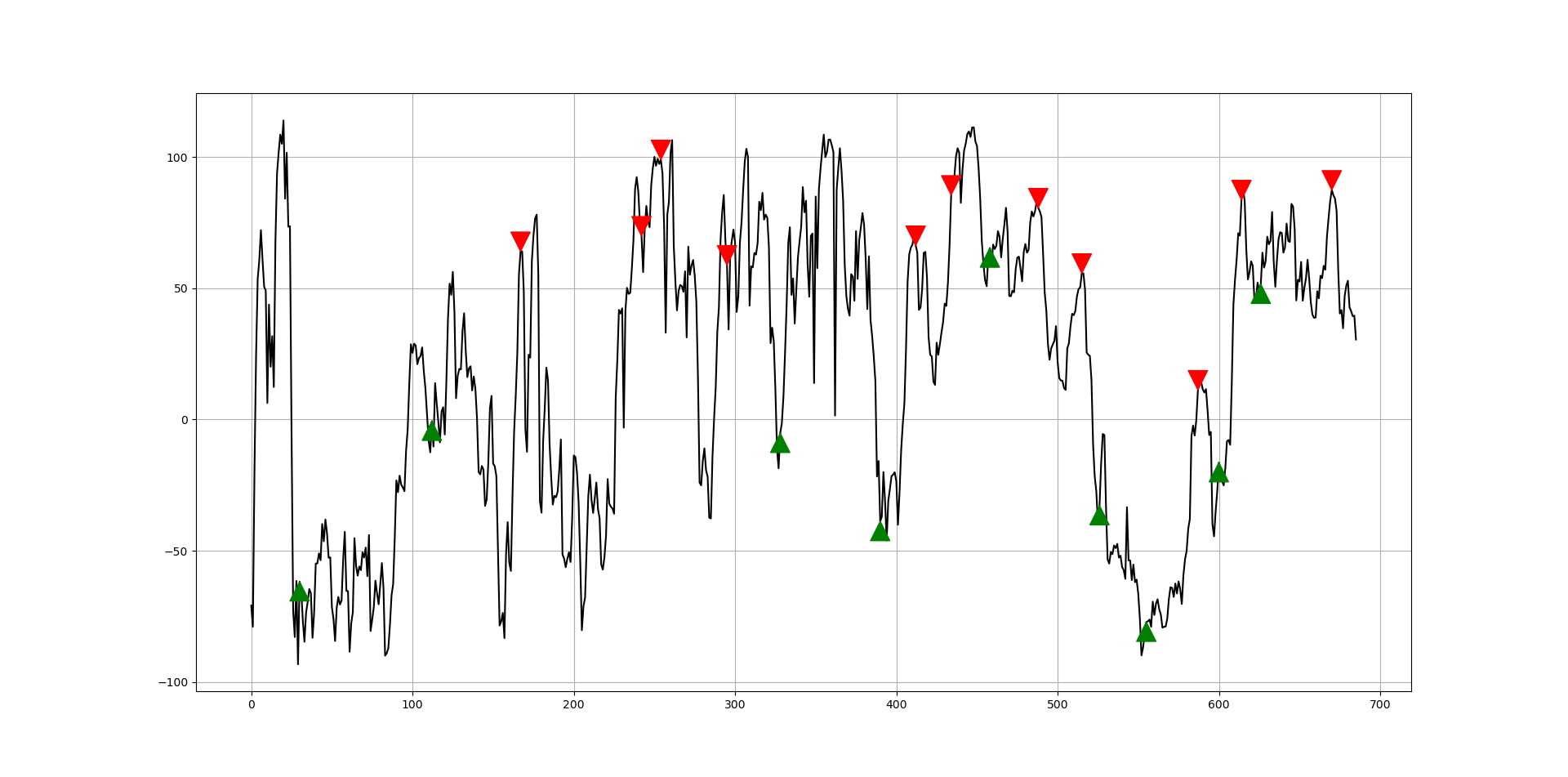

THE AAII

The AAII is an equity-based sentiment indicator published by the American Association of Individual Investors. The strategy used combines it with the RSI and a 100-Day moving average.

The following Figure shows the recent signal chart.

Conclusion

Bullish bias remains on the indicator.

Historical Track Record

The next table shows the historical non-binding track record of the model. Remember that past results are not representative of future results.

THE COT METER

The U.S Commodity Futures Trading Commission (CFTC) publishes statistics of the futures market on a weekly basis called the Commitment of Traders (COT) report. The report has many valuable information inside, namely the number of futures contracts held by market participants (hedge funds, banks, producers of commodities, speculators, etc.).

Two main categories have to be distinguished before going further:

Commercial players: They deal in the futures markets for hedging purposes (i.e. to cover their operations or other trading positions). Examples of hedgers include investment banks and agricultural giants. Their positions are negatively correlated with the underlying market.

Non-commercial players: They deal in the futures markets for speculative reasons (i.e. to profit from their positions). Examples of speculators include hedge funds. Their positions are positively correlated with the underlying market.

The COT meter takes the difference between the net non-commercial players and the net commercial players in order to get a final net value which is supposed to be positively correlated to the underlying asset.

For example, if the Canadian Dollar is showing an extreme value of 100, then this means that taking into account the past 52 weeks, the net market positioning has been overly bullish which could mean that a correction may be likely.

The current COT values have a 1-week delay according to the website due to a technical issue.

The bullish Canadian dollar and the extremely bearish EUR gives rise to an interesting opportunity on EURCAD.

COT PATTERN RECOGNITION

The COT pattern recognition system considers the strong correlation between the net COT values and the followed financial instrument. For example, there is a positive correlation between the net EUR COT value and the EURUSD pair. In contrast, there is a negative correlation between the net CAD COT value and the USDCAD pair.

The current COT values have a 1-week delay according to the website due to a technical issue.

DISCLAIMER

Every information contained in the report is solely for the purpose of showing another angle. Since it is NOT investment advice or trade recommendations, you must NOT use the report as the sole reason for your trading and investing activities.

Make sure you know how to include the above elements in your trading framework in a way that does not change your methodology but in a way that gives you conviction on your pre-existing ideas.

Data can have many representations and the information presented is but one side of the story which may be incomplete. All back-testing and forward testing results reflect their own time period and not the future as is the case in every research piece.

The information contained in the report are proprietary and only YOU are permitted to use it. If you have to share it, please state the source correctly by referring the page of the Newsletter.