The Weekly Market Sentiment Report: 28th January - 4th February 2024

The Weekly Market Sentiment Report: 28/01/2024- 04/02/2024

CONTENTS

EVOLUTION & NATURE OF THE REPORT

ECONOMIC CALENDAR

CORRELATION HEATMAP

THE COT REPORT - THE LEAD STRATEGY

THE COT REPORT - PATTERN RECOGNITION

THE STRUCTURAL EQUITY SENTIMENT INDEX

THE STRUCTURAL DOLLAR SENTIMENT INDEX

THE EQUITY PUT-CALL RATIO SENTIMENT

GERMANY ZEW ECONOMIC SENTIMENT INDEX

THE ISM PURCHASING MANAGER’S INDEX

THE UNIVERSITY OF MICHIGAN CONSUMER SENTIMENT INDEX

THE LEAD STRATEGY TRACK RECORD

DISCLAIMER

EVOLUTION OF THE REPORT

This report will grow in time due to feedback and new techniques put into place. New sentiment models are constantly added while taking into account their overall utility. Feel free to leave a feedback (e.g. nature of the document, its usefulness, its time interval, its content, language, etc.).

The directional views are represented using the following convention and are followed by their charts:

⚡ This symbol represents a new directional opportunity.

🔁 This symbol represents an on-going directional opportunity.

✅ This symbol represents a recently closed opportunity at a profit.

❌ This symbol represents a recently closed opportunity at a loss.

The directional views presented must simply be used to help confirm the overall expected direction of the analyzed market. The support and resistance zones are not hard levels, they are merely areas of expected reactions (reversals), and hence for risk management purposes, you are advised to place your stops as you see fit. Naturally, when the market clearly breaks the reversal zone, the view is invalidated, however some noise may occur around it before we see a clear reaction.

ECONOMIC CALENDAR

An economic calendar is a tool used in finance and economics to track and display upcoming economic events, announcements, and indicators that are relevant to the financial markets and the broader economy. The following shows what to expect for the coming week.

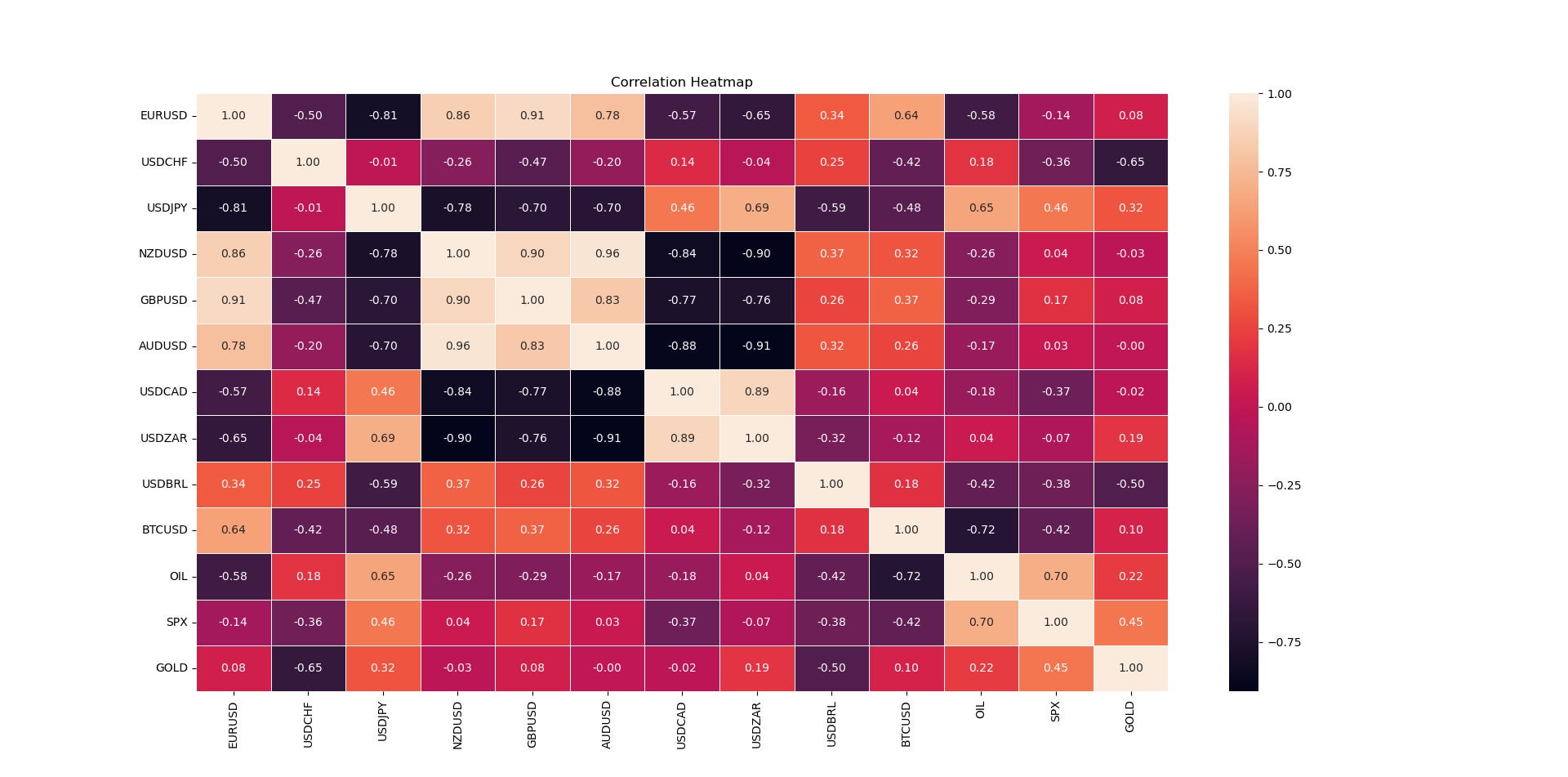

CORRELATION HEATMAP

Correlation is a statistical measure that quantifies the relationship between variables. It measures how closely the returns of two or more assets move together. It ranges from -1 to 1. Understanding the correlations between different markets and asset classes is crucial for managing risk and expectations. The following shows the heatmap between different key markets.

A correlation close to -1.00 implies a negative relationship between the two markets (they move in opposite directions), while a correlation close to 1.00 implies a positive relationship between the two markets (they move in the same direction). Finally, a correlation close to zero implies that there is no linear relationship between the two markets (they may or may not move in the same direction).

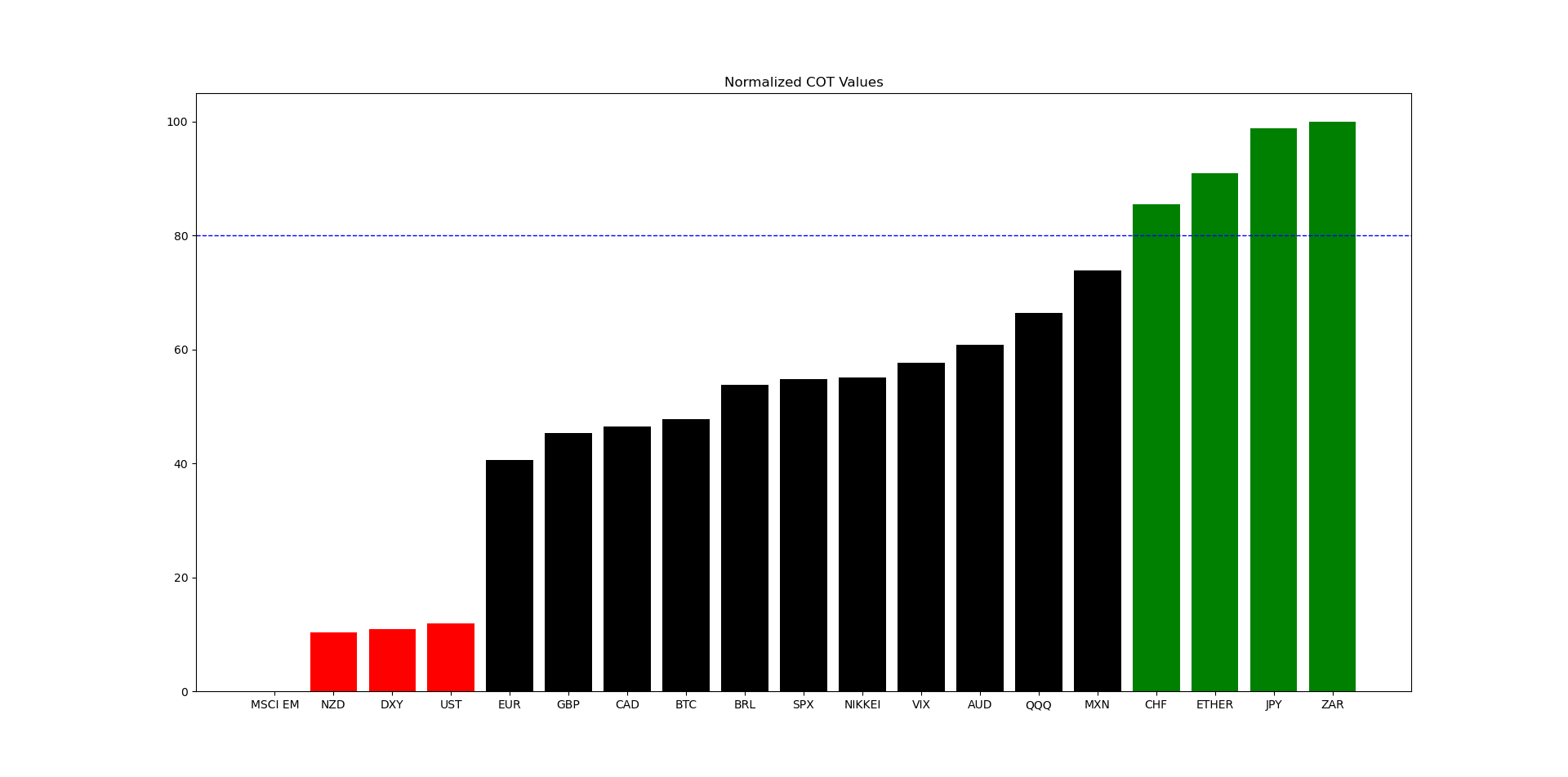

THE COT REPORT - THE LEAD STRATEGY

The CFTC publishes statistics of the futures market on a weekly basis called the Commitment of traders (COT) report. The report has many valuable information inside, namely the number of futures contracts held by market participants (hedge funds, banks, producers of commodities, speculators, etc.). Two main categories must be distinguished:

Commercial players: They deal in the futures markets for hedging purposes (i.e. to cover their operations or other trading positions). Examples of hedgers include investment banks and agricultural giants. Their positions are negatively correlated with the underlying market.

Non-commercial players: They deal in the futures markets for speculative reasons (i.e. to profit from their positions). Examples of speculators include hedge funds. Their positions are positively correlated with the underlying market.

The lead strategy is the core of this report. It highlights the markets that are overbought or oversold with regards to sentiment. The key views are found by combining different markets together. For example, if the EUR has an extremely bearish sentiment and the CAD has an overly bullish sentiment, then a bullish position on EURCAD can be interesting if the technicals justify it.

The following table summarizes the current state of the sentiment for FX and IX markets:

Make sure to remember that theses are not advices whatsoever, they are merely charts that fuse sentiment analysis with technical analysis:

⚡ EURJPY: Bullish move expected around 159.30/158.50 to 163.00.

⚡ USDMXN: Bullish move expected around 17.08/16.95 to 17.55.

Keep reading with a 7-day free trial

Subscribe to The Weekly Market Sentiment Report to keep reading this post and get 7 days of free access to the full post archives.