The Weekly Market Sentiment Report: 6th August - 13th August 2023

The Weekly Market Sentiment Report: 06/08/2023 - 13/08/2023

CONTENTS

EVOLUTION OF THE REPORT

ECONOMIC CALENDAR

THE COMMITMENT OF TRADERS REPORT: NORMALIZED VALUES

THE COMMITMENT OF TRADERS REPORT: PATTERN RECOGNITION

THE BULLISH SENTIMENT INDEX

THE NAAIM EXPOSURE INDEX

RISK REVERSAL

THE PUT-CALL RATIO SENTIMENT

THE GAMMA EXPOSURE INDEX

THE AMERICAN ASSOCIATION OF INDIVIDUAL INVESTORS

GERMANY ZEW ECONOMIC SENTIMENT INDEX

THE ISM PURCHASING MANAGER’S INDEX

THE UNIVERSITY OF MICHIGAN CONSUMER SENTIMENT INDEX

COT SIGNALS TRACK RECORD

DISCLAIMER

EVOLUTION OF THE REPORT

This report will grow in time due to feedback and new techniques put into place. You may notice new markets added or other markets removed. Similarly, new sentiment models may be added or removed. Feel free to leave a feedback (e.g. nature of the document, its usefulness, its time interval, its content, language, etc.).

⚡ This symbol represents a new directional opportunity.

🔁 This symbol represents an on-going directional opportunity.

✅ This symbol represents a recently closed opportunity at a profit.

❌ This symbol represents a recently closed opportunity at a loss.

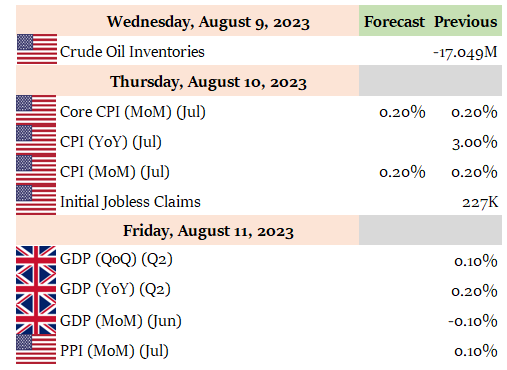

ECONOMIC CALENDAR

THE COMMITMENT OF TRADERS REPORT: NORMALIZED VALUES

The U.S Commodity Futures Trading Commission (CFTC) publishes statistics of the futures market on a weekly basis called the Commitment of Traders (COT) report. The report has many valuable information inside, namely the number of futures contracts held by market participants (hedge funds, banks, producers of commodities, speculators, etc.). Two main categories have to be distinguished:

Commercial players: They deal in the futures markets for hedging purposes (i.e. to cover their operations or other trading positions). Examples of hedgers include investment banks and agricultural giants. Their positions are negatively correlated with the underlying market.

Non-commercial players: They deal in the futures markets for speculative reasons (i.e. to profit from their positions). Examples of speculators include hedge funds. Their positions are positively correlated with the underlying market.

The COT meter takes the difference between the net non-commercial players and the net commercial players in order to get a final net value which is supposed to be positively correlated to the underlying asset.

For example, if the Canadian Dollar is showing an extreme value of 100, then this means that taking into account the past 26 weeks (6 months), the net market positioning has been overly bullish which could mean that a correction may be likely. The following table summarizes the current state of the markets with the optimal opportunities:

Make sure to remember that theses are no advices whatsoever, they are merely charts on COT signals:

⚡SPX/BTCUSDT should underperform around 0.18/0.20 to 0.13. This means that in case the ratio shapes a push-up to the resistance zone, equity markets should underperform cryptocurrencies.

⚡BTCCAD showing bullish signals above 36830/34950 to 42000

🔁 NZDCAD showing bullish signals above 0.8060/0.7960 to 0.8400.

🔁 EURAUD showing bearish signals below 1.6750/1.6850 to 1.6300.

🔁 AUDBRL still showing bullish signals above 3.15 to 3.56. The position is not looking good at the moment. Allowing for some noise tolerance before closing at a loss.

🔁 BRLJPY still showing bearish signals below 30.20/31.20 to 27.60.

⚠️ The track record of the COT signals can be found at the end of the report ⚠️

Keep reading with a 7-day free trial

Subscribe to The Weekly Market Sentiment Report to keep reading this post and get 7 days of free access to the full post archives.