The Weekly Market Sentiment Report: 22nd October - 29th October 2023

The Weekly Market Sentiment Report: 22/10/2023 - 29/10/2023

CONTENTS

EVOLUTION OF THE REPORT

ECONOMIC CALENDAR

THE COMMITMENT OF TRADERS REPORT: NORMALIZED VALUES

THE COMMITMENT OF TRADERS REPORT: PATTERN RECOGNITION

THE BULLISH SENTIMENT INDEX

THE PUT-CALL RATIO SENTIMENT

THE STATISTICAL SENTIMENT INDEX

THE AMERICAN ASSOCIATION OF INDIVIDUAL INVESTORS

GERMANY ZEW ECONOMIC SENTIMENT INDEX

THE ISM PURCHASING MANAGER’S INDEX

THE UNIVERSITY OF MICHIGAN CONSUMER SENTIMENT INDEX

COT SIGNALS TRACK RECORD

DISCLAIMER

EVOLUTION OF THE REPORT

This report will grow in time due to feedback and new techniques put into place. New sentiment models may be added or removed. Feel free to leave a feedback (e.g. nature of the document, its usefulness, its time interval, its content, language, etc.).

⚡ This symbol represents a new directional opportunity.

🔁 This symbol represents an on-going directional opportunity.

✅ This symbol represents a recently closed opportunity at a profit.

❌ This symbol represents a recently closed opportunity at a loss.

ECONOMIC CALENDAR

THE COMMITMENT OF TRADERS REPORT: NORMALIZED VALUES

The U.S Commodity Futures Trading Commission (CFTC) publishes statistics of the futures market on a weekly basis called the Commitment of Traders (COT) report. The report has many valuable information inside, namely the number of futures contracts held by market participants (hedge funds, banks, producers of commodities, speculators, etc.). Two main categories have to be distinguished:

Commercial players: They deal in the futures markets for hedging purposes (i.e. to cover their operations or other trading positions). Examples of hedgers include investment banks and agricultural giants. Their positions are negatively correlated with the underlying market.

Non-commercial players: They deal in the futures markets for speculative reasons (i.e. to profit from their positions). Examples of speculators include hedge funds. Their positions are positively correlated with the underlying market.

The COT meter takes the difference between the net non-commercial players and the net commercial players in order to get a final net value which is supposed to be positively correlated to the underlying asset.

For example, if the Canadian Dollar is showing an extreme value of 100, then this means that taking into account the past 26 weeks (6 months), the net market positioning has been overly bullish which could mean that a correction may be likely. The following table summarizes the current state of the markets with the optimal opportunities:

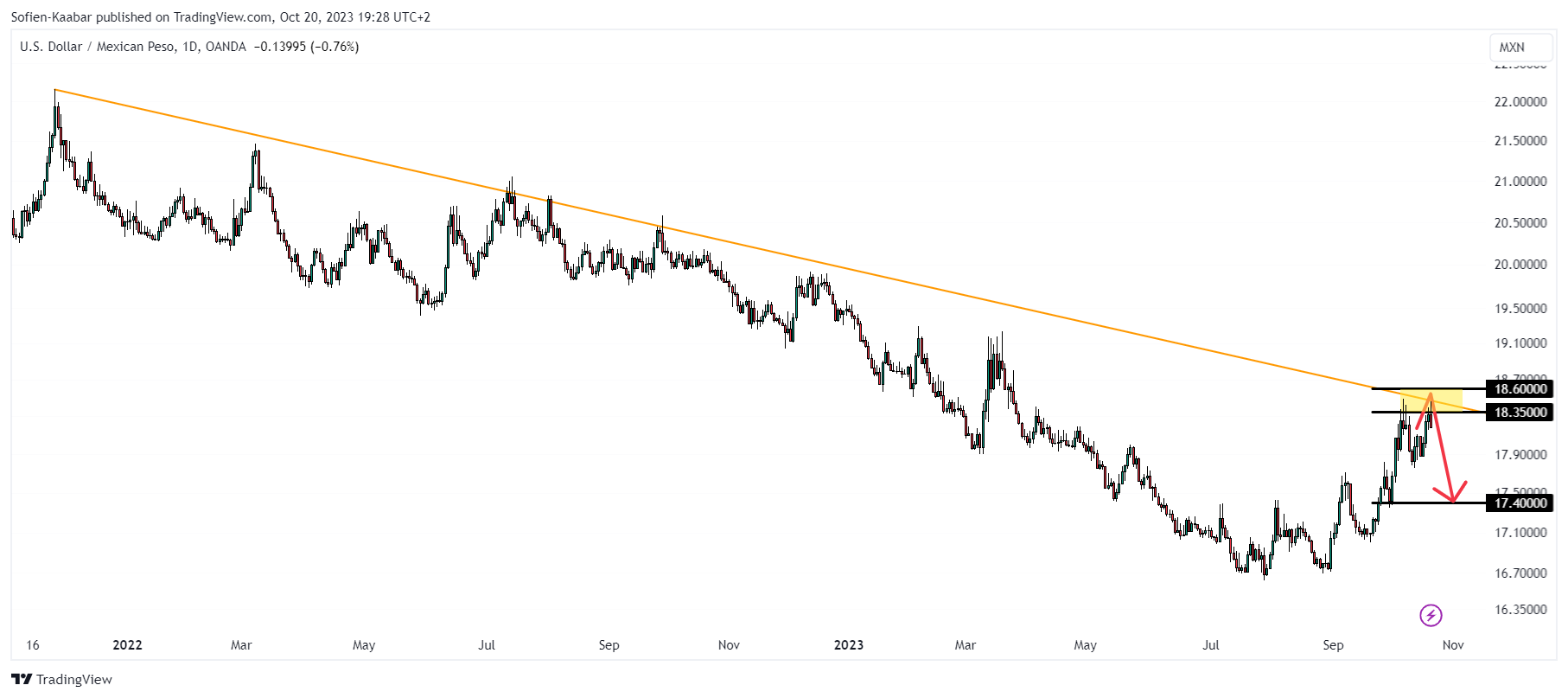

Make sure to remember that theses are not advices whatsoever, they are merely charts that fuse sentiment analysis (COT values) with technical analysis:

🔁 USDMXN: Bearish view expected below 18.35/18.60 to 17.40.

🔁 EURUSD: Bullish view expected above 1.0400/1.0290 to 1.0750.

🔁 NZDUSD: Bullish view expected above 0.5865/0.5800 to 0.6135.

✅ BTCCAD: Potential seen.

✅ NZDCAD: Potential seen.

⚠️ The track record of the COT signals can be found at the end of the report ⚠️

The following table summarizes the current state of the commodity markets with the optimal opportunities:

Make sure to remember that theses are not advices whatsoever, they are merely charts that fuse sentiment analysis (COT values) with technical analysis:

⚡OIL/SUGAR: Bullish move expected above 2.60/2.47 to 3.03.

✅ SUGAR/GOLD: Potential seen.

✅ SUGAR/CORN: Potential seen.

✅ COCOA/CORN: Potential seen.

✅ COCOA/SUGAR: Potential seen.

You can also check out my other newsletter The Weekly Market Analysis Report that sends tactical directional views every weekend to highlight the important trading opportunities using technical analysis that stem from modern indicators. The newsletter is free.

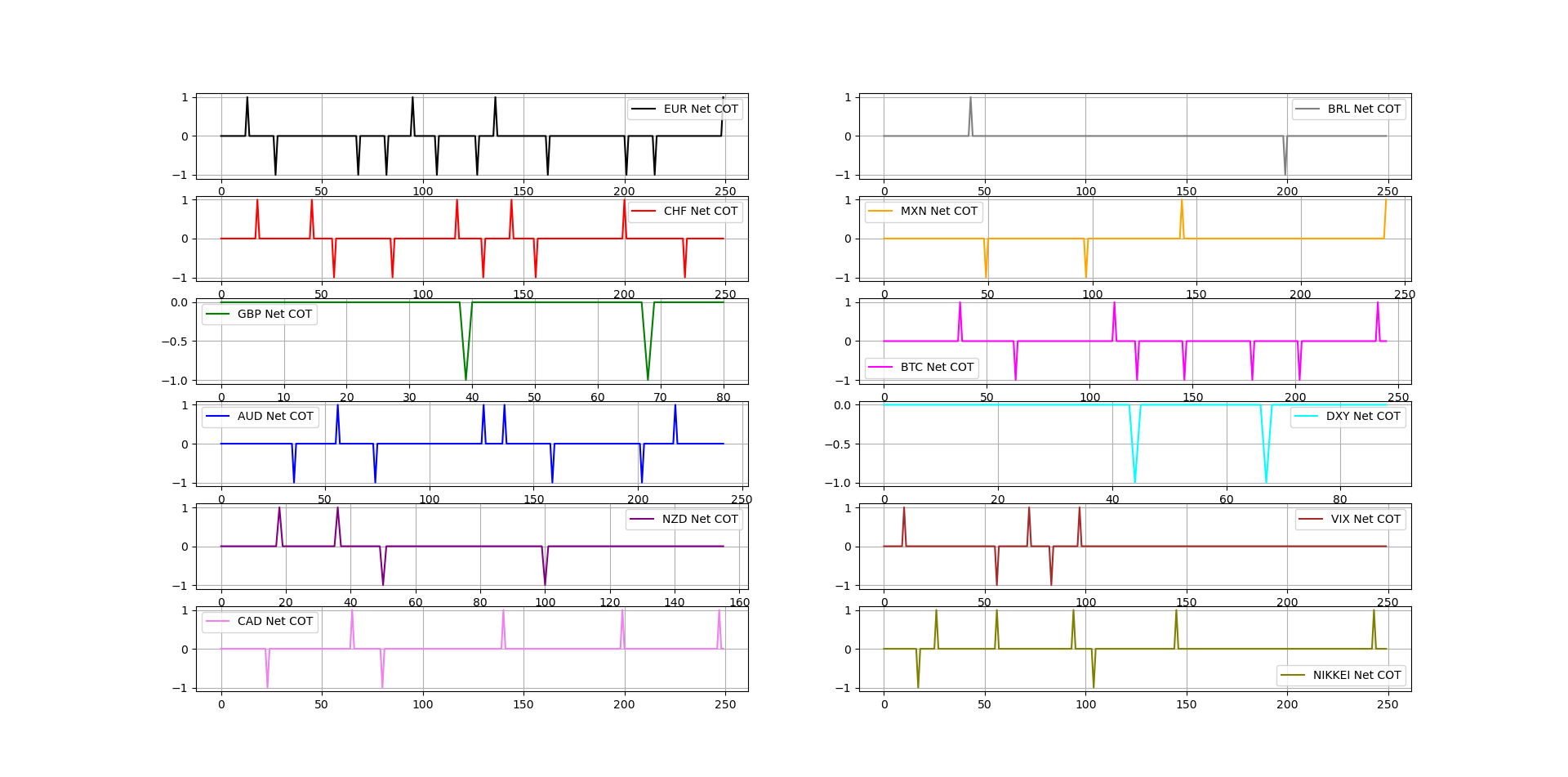

THE COMMITMENT OF TRADERS REPORT: PATTERN RECOGNITION

Pattern recognition is a cognitive process that involves the identification, organization, and interpretation of patterns or regularities in data, information, or sensory stimuli. It is the ability to recognize and extract meaningful information from complex or noisy input by identifying underlying structures or relationships. This model applies a certain pattern on the COT values in order to predict local tops and bottoms.

Every week, the model scans the universe of the COT values applied on a certain number of markets and outputs the market(s) where the pattern is detected. The underlying hypothesis is that the market is heavily correlated with its COT values and therefore:

A bullish pattern on the COT values imply a bullish signal on the market.

A bearish pattern on the COT values imply a bearish signal on the market.

The following charts show the current state of the net COT values of each market. Whenever the market is at 1, a bearish pattern has just been detected and whenever it is at -1, a bullish pattern has just been detected. Currently, last week, Nikkei 225 has printed a bearish COT pattern.

The following chart shows the expected reactions from the current and the previous patterns:

⚡ EURUSD: A bullish pattern has been detected to reinforce the signal from the normalized COT strategy.

The previous signals of the pattern on the net EUR COT value were as follows:

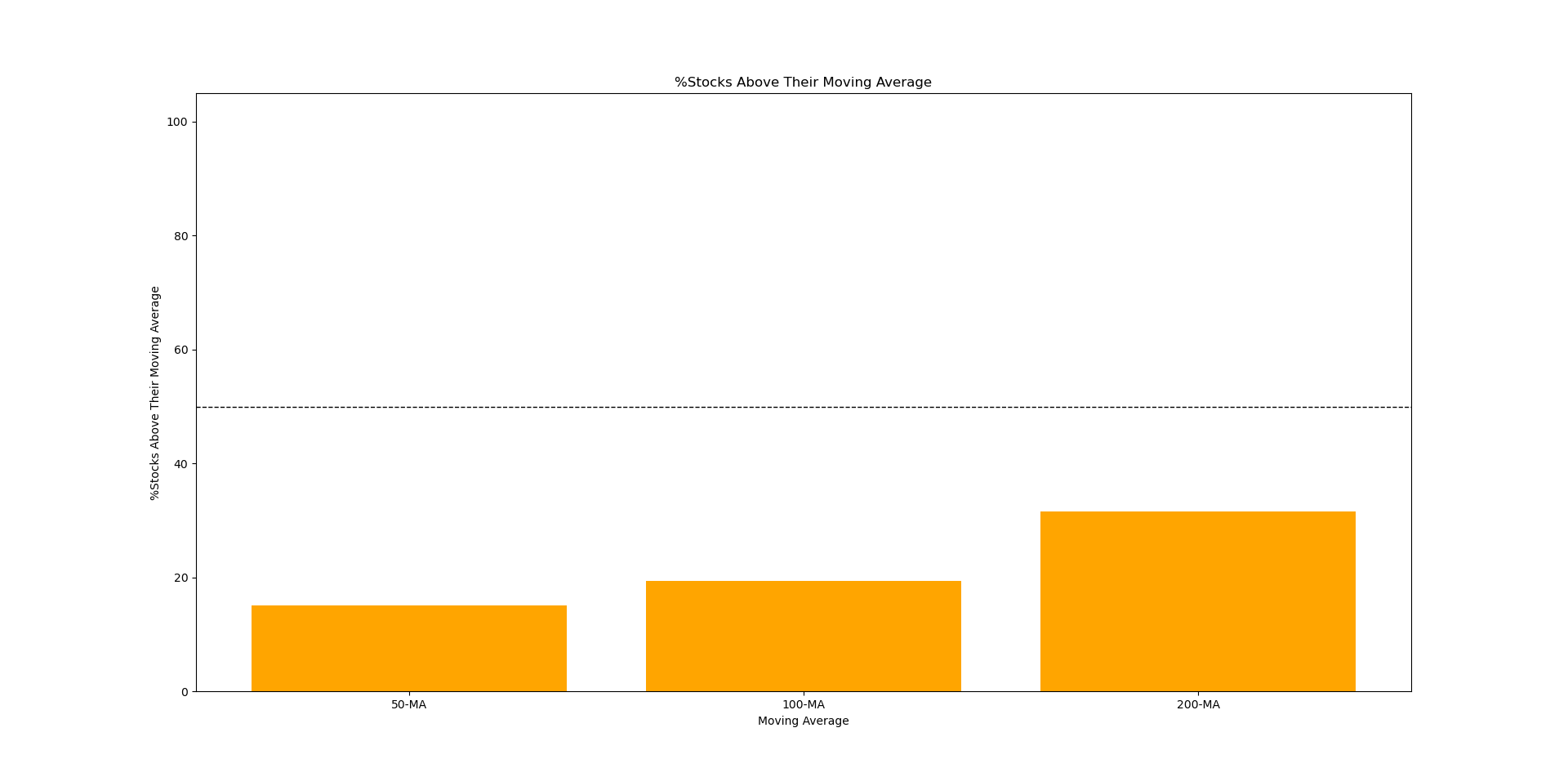

THE BULLISH PERCENTAGE INDEX

This index simply calculates the percentage of stocks in the S&P 500 that are above their 50-Day, 100-Day, and 200-Day moving average. It represents a sentiment shift if single stocks start breaking or surpassing their respective moving averages. The following are the latest values:

The interpretation of the bullish percentage index is discretionary, but generally high values (close to 90%-100%) are correlated with corrective phases while low values (close to 10%-0%) are correlated with recovery phases. Currently, it is obvious that the index is below 50% which is a bearish sentiment arriving to its end soon.

THE PUT-CALL RATIO SENTIMENT

The equity put-call ratio published by the CBOE gives insights to the current market stress. Historically, the correlation with the stock market (S&P 500) has been intuitively negative with around -0.40 correlation using the Spearman rank correlation coefficient (with -0.32 correlation given using the Pearson correlation coefficient). Similarly, the maximal information coeffcient (MIC) which measures the degree of non-linear relationship has given 0.20 which suggests there is a relationship between the two time series (whether negative or positive).

Conclusion: The scanner is neutral. Typically, the signals are short-lived and the reaction is expected to last for 5-8 days.

The following chart shows the equity curve of the strategy since inception:

STATISTICAL SENTIMENT INDEX

The statistical sentiment index (SSI) is a new calculation I have developed to aid in forecasting tactical market directions. The SSI is composed of a selected indicators and calculations in order to find overheating moments. The following table sums up the current sentiment view on a selection of markets.

Here’s this week’s current state of the SSI:

The above table can have six different states:

Bullish signal generated: This signal is generated whenever the conditions of the SSI are met for an expected bullish price action after a sentiment shift.

Bullish signal imminent: This state is generated when a bullish signal is expected soon.

Neutral territory: This state occurs when the SSI is in neutral territory and is not showing any directional elements.

Bearish signal imminent: This state is generated when a bearish signal is expected soon.

Bearish signal generated: This signal is generated whenever the conditions of the SSI are met for an expected bearish price action after a sentiment shift.

The following charts are examples of generated signals in the past using the SSI.

THE AMERICAN ASSOCIATION OF INDIVIDUAL INVESTORS

The AAII is an equity-based sentiment indicator published by the American Association of Individual Investors every week. The sentiment strategy combines it with the 200-Day moving average.

Conclusion: No signal detected by the model at the moment. However, the index is approaching the buying zone.

GERMANY ZEW ECONOMIC SENTIMENT INDEX

The Germany ZEW Economic Sentiment Index is a widely recognized economic indicator that measures the sentiment or expectations of financial experts and analysts regarding the German economy. ZEW stands for "Zentrum für Europäische Wirtschaftsforschung" or the Center for European Economic Research, which is a prominent economic research institute based in Germany.

The ZEW Economic Sentiment Index is calculated by surveying a panel of around 300 financial experts, including analysts and institutional investors, who are asked to provide their outlook on the German economy for the next six months. These experts are asked to evaluate factors such as economic growth prospects, inflation expectations, employment conditions, and other relevant economic indicators.

The index is constructed by taking the percentage of positive responses and subtracting the percentage of negative responses. A positive index value indicates optimism and suggests that economic conditions are expected to improve in the near future, while a negative value indicates pessimism and suggests expectations of worsening economic conditions.

The Germany ZEW Economic Sentiment Index is closely monitored by investors, policymakers, and economists as it provides valuable insights into the sentiment and expectations of market participants. It can have an impact on financial markets, as changes in sentiment can influence investment decisions and market movements.

It's important to note that the ZEW Economic Sentiment Index reflects the opinions of experts and analysts, and it is not a direct measurement of actual economic data or outcomes. Nevertheless, it serves as a valuable leading indicator of economic sentiment in Germany.

The model forecasts the next direction of the index which can be used to trade the direction of EURUSD.

Theoretical expectation: A reaction of 1 month is expected following a signal.

Conclusion: It seems that the model is neutral for the moment. No signal in sight given the current levels. However, it’s worth noting that it’s dipping in the negative territory at the moment.

Bear in mind that the Germany ZEW is published on a monthly basis.

THE ISM PMI

The institute for supply management provides a monthly survey called the purchasing manager’s index abbreviated to ISM PMI, which is based on questions asked to 400 representatives of industrial companies about the current and future trend of their different activities. It is composed of 5 components that can also be analyzed individually:

New orders — 30% weight.

Production — 25% weight.

Employment — 20% weight.

Supplier Deliveries — 15% weight.

Inventories — 10% weight.

Typically, we interpret the index as 50 being the neutral state of the economy (neither growing and neither shrinking). A reading above 50 indicates an expansion in manufacturing and a reading below 50 indicates shrinking in manufacturing.

Theoretical expectation: A reaction of 18 months is expected following a signal.

Conclusion: It seems that the model is neutral for the moment after signalling a top in 2021. No signal in sight given the current levels.

Bear in mind that the ISM PMI is published on a monthly basis.

You can also check out my other newsletter All About Trading! that shares regularly diverse trading articles designed to improve your knowledge of the markets. This is a must-subscribe newsletter!

THE UNIVERSITY OF MICHIGAN CONSUMER SENTIMENT INDEX

The University of Michigan Consumer Sentiment Index is a measure of consumer confidence or optimism about the economy, as well as their own financial situation. The index is compiled by the University of Michigan's Survey Research Center and is based on a survey of 500 households conducted each month.

The index is derived from responses to a series of questions regarding consumers' expectations for the economy, inflation, interest rates, employment, and their own financial situation. The responses are scored and weighted, with a higher score indicating greater consumer confidence. The Consumer Sentiment Index is often used to gauge the potential impact of economic policies or events on consumer behavior.

Conclusion: It seems that the sentiment index is showing long-term bullishness according to the historical support area. Short-term fluctuations are neglected.

COT SIGNALS TRACK RECORD

You will find in this section the details of the previous COT signals. Note that this track record is only for illustrative purposes, it is not supposed to attract or sollicit any type of action. It is a bookkeeping way of making sure that the techniques used are still delivering value:

All these views can be verified by accessing the previous newsletter in the homepage. The hit ratio is calculated using the directional method. This means that the moment the analysis published, an entry is assumed. If the target has been approached or attained, then the view is recorded as a good forecast. Otherwise, if the market clearly breaks the reaction area (support or resistance), it is recorded as a bad forecast.

Do not hesitate to share your thoughts and forecasts in the comment section.

DISCLAIMER

Every information contained in the report is solely for the purpose of showing another angle. Since it is NOT investment advice or trade recommendations, you must NOT use the report as the sole reason for your trading and investing activities.

Trading is fun, enriching, and interesting but not when it comes at the expense of your hard-earned funds. Do not risk what you cannot afford to lose. You must only trade with money you have already considered gone and you must not use trading as your sole revenue generator. Risk management is even more important than the trading strategy itself, make sure to master it.

Data can have many representations and the information presented is but one side of the story which may be incomplete. All back-testing and forward testing results reflect their own time period and not the future as is the case in every research piece.