The Weekly Market Sentiment Report: 7th October - 11th October 2024

The Weekly Market Sentiment Report: 07/10/2024 - 11/10/2024

CONTENTS

EVOLUTION & NATURE OF THE REPORT

ECONOMIC CALENDAR

MARKET SNAPSHOT

THE COT REPORT STRATEGY

PUT-CALL RATIO SENTIMENT INDEX

THE GAMMA EXPOSURE INDEX

THE MOVING AVERAGE PERCENTAGE INDEX

THE RSI PERCENTAGE INDEX

EQUITY YEARLY MILESTONE INDEX

VOLATILITY INDICES

THE AAII INVESTOR SENTIMENT SURVEY

THE ISM PURCHASING MANAGER’S INDEX (ISM PMI)

THE COT REPORT STRATEGY TRACK RECORD

CORRELATION HEATMAP

RECENTLY CLOSED OPPORTUNITIES

DISCLAIMER

EVOLUTION & NATURE OF THE REPORT

New sentiment models are constantly added while taking into account their overall utility. Feel free to leave a feedback (e.g. nature of the document, its usefulness, its time interval, its content, language, etc.).

The directional views are represented using the following convention and are followed by their charts:

⚡ This symbol represents a new directional opportunity.

🔁 This symbol represents an on-going directional opportunity.

✅ This symbol represents a recently closed opportunity at a profit.

❌ This symbol represents a recently closed opportunity at a loss.

The directional views presented must simply be used to help confirm the overall expected direction of the analyzed market. The support and resistance zones are not hard levels, they are merely areas of expected reactions (reversals), and hence for risk management purposes, you are advised to place your stops as you see fit. Naturally, when the market clearly breaks the reversal zone, the view is invalidated, however some noise may occur around it before we see a clear reaction.

If you want to see more explanatory details on the below report, you can refer to the following post:

ECONOMIC CALENDAR

An economic calendar is a tool used in finance and economics to track and display upcoming economic events, announcements, and indicators that are relevant to the financial markets and the broader economy. The following shows what to expect for the coming week:

MARKET SNAPSHOT

The below table summarizes the weekly changes of some of the key markets:

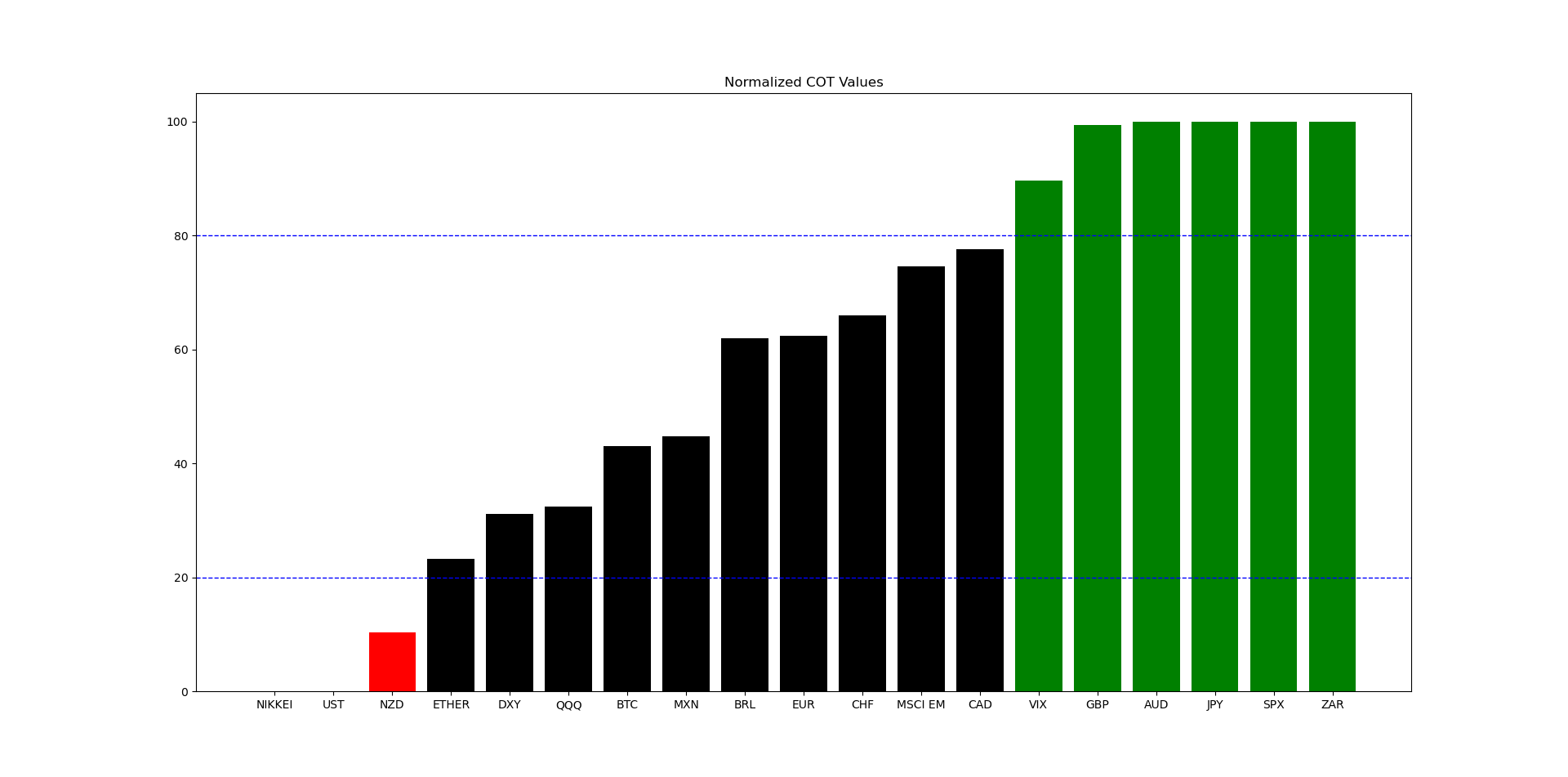

THE COT REPORT STRATEGY

The CFTC publishes statistics of the futures market on a weekly basis called the Commitment of traders (COT) report. The report has many valuable information inside, namely the number of futures contracts held by market participants (hedge funds, banks, producers of commodities, speculators, etc.).

💡 Relevant Information 💡

Two main categories in the COT report must be distinguished:

Commercial players: They deal in the futures markets for hedging purposes (i.e. to cover their operations or other trading positions). Examples of hedgers include investment banks and agricultural giants. Their positions are negatively correlated with the underlying market.

Non-commercial players: They deal in the futures markets for speculative reasons (i.e. to profit from their positions). Examples of speculators include hedge funds. Their positions are positively correlated with the underlying market.

The COT report strategy is the core of this report. It highlights the markets that are overbought or oversold with regards to sentiment.

The following table summarizes the current state of the sentiment for currencies and indices:

Make sure to remember that theses are not advices whatsoever, they are merely charts that fuse sentiment analysis with technical analysis:

⚡SPX/NIKKEI: Bearish reaction expected around 0.15/0.154 to 0.138.

⚡USDJPY: Bullish reaction expected around 145.70/144.60 to 152.70.

🔁 BTCUSD: Bullish reaction expected around 62,750/60,700 to 72,330.

Update: Maintaining the view with the same levels.

🔁 NZDGBP: Bullish reaction expected around 0.4690/0.4665 to 0.4840.

Update: Maintaining the view with the same levels.

🔁 NZDJPY: Bearish reaction expected around 88.26/87.15 to 94.33.

Update: Maintaining the view with the same levels.

🔁 SPX/NASDAQ: Bullish reaction expected around 0.29/0.28 to 0.30/0.31.

Update: Maintaining the view with the same levels.

🔁 EURMXN: Bearish reaction expected around 21.76/22.29 to 20.30.

Update: Maintaining the view with the same levels.

🔁 USDBRL: Bearish reaction expected around 5.60/5.67 to 5.30.

Update: Maintaining the view with the same levels.

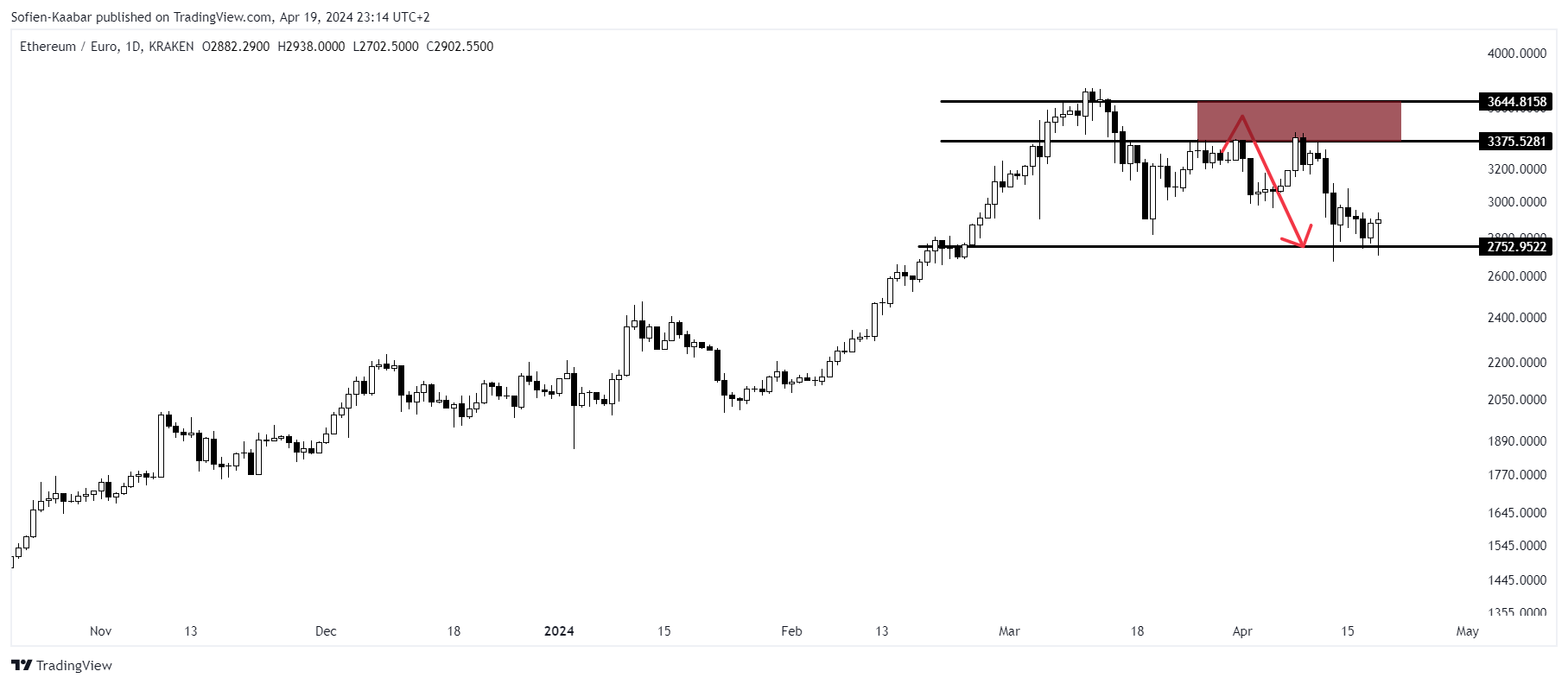

🔁 ETHUSD: Bullish reaction expected around 2330/2150 to 3140.

Update: Maintaining the view with the same levels.

🔁 CADJPY: Bullish reaction expected around 104.88/103.25 to 111.00.

Update: Maintaining the view with the same levels.

❌ AUDNZD: View invalidated.

✅ EURUSD: Potential seen/approached.

💡 Relevant Information 💡

The views are found by combining different markets together. For example, if the EUR has an extremely bearish sentiment and the CAD has an overly bullish sentiment, then a bullish position on EURCAD can be interesting if the technical elements justify it.

The following table summarizes the current state of the sentiment for commodities:

Make sure to remember that theses are not advices whatsoever, they are merely charts that fuse sentiment analysis with technical analysis:

⚡ CORN: Bearish reaction expected around 4.14/4.21 to 3.91.

🔁 SUGAR: Bearish reaction expected around 7866/7383 to 20.75.

Update: Maintaining the view with the same levels.

🔁 PLATINUM: Bearish reaction expected around 1000/1014 to 940.

Update: Maintaining the view with the same levels.

✅ COCOA: Potential seen/approached.

⚠️ Relevant Information ⚠️

The track record of the COT report strategy can be found at the end of the newsletter.

PUT-CALL RATIO SENTIMENT INDEX

The equity put-call ratio (PCR), published by the CBOE gives insights to the current market anxiety. It is the number of puts divided by the number of calls. Historically, the correlation with the stock market (S&P 500) has been intuitively negative at ~ -0.40 using the Spearman rank correlation and ~ -0.32 using the Pearson correlation coefficient.

💡 Relevant Information 💡

Correlation is a statistical measure that tells us if there's a relationship between two variables and how strong that relationship is.

Pearson correlation is used when both variables are continuous and follow a linear relationship, meaning when one variable goes up, the other tends to go up or down predictably. Spearman correlation, on the other hand, is used when the relationship is not necessarily linear.

Additionally, the maximal information coefficient (MIC) which measures the degree of non-linear relationship is ~ 0.20, which suggests there is a relationship between the two time series (whether negative or positive). The following chart shows the current and past signals.

🔎 Interpretation 🔎

A new bullish signal has been detected by the scanner last week. Expecting another positive coming week.

Reminder, the following are the results of the strategy so far:

Total hit ratio = 78.57%

Gross profit factor = 4.18

Number of signals = 42

THE GAMMA EXPOSURE INDEX

The gamma exposure index (GEX) is a measure used in the options market to assess the sensitivity of the market's gamma exposure to price changes. Essentially, gamma provides insight into the convexity or curvature of the option's price in relation to movements in the underlying asset's price.

The GEX quantifies this gamma exposure across a market or a specific underlying asset. A higher GEX suggests a greater sensitivity of the market to price changes, indicating potential volatility due to hedging activities. Conversely, a lower GEX suggests less sensitivity and potentially lower volatility. The correlation between the S&P 500 and the GEX is quite high, which may give interesting timing opportunities.

Here’s how I use the GEX:

A bullish signal is generated whenever the 200-day normalized value of the index reaches the area of around -2.00.

A bearish signal is generated whenever the 200-day normalized value of the index reaches the area of around +2.00. It is worth noting that the bearish signals have a low conviction.

The following chart shows the current GEX situation.

🔎 Interpretation 🔎

Currently, the GEX is not far from 2.00. A small push-down confirms the bullish signal on the index in tandem with the bullish signal on the PCR.

THE MOVING AVERAGE PERCENTAGE INDEX

The first index calculates the percentage of stocks in the S&P 500 that are above their 50-Day moving average. A rule of thumb of this index is to use it as follows:

A bullish signal is generated whenever the index surpasses 20%, thus indicating that more stocks are surpassing their moving average.

A bearish signal is generated whenever the index breaks 80%, thus indicating that more stocks are breaking their moving average.

The following shows the evolution of the index versus the S&P 500.

🔎 Interpretation 🔎

The index remains neutral. During a predominantly bullish trend, if the index approaches once again the 20% level, a strong bullish signal is generated and a rotation to US stocks will be heavily recommended.

Currently, there is no evidence to suggest that the index can provide bearish signals. Hence, the focus will only be on bullish signals. But the approach of 80% definitely reduces any bullish conviction for the coming days (as witnessed by the recent price action).

The second index calculates the percentage of the USD major crosses that are above their 20-Day moving average. A rule of thumb of this index is to use it as follows:

A bullish signal is generated whenever the index surpasses 25%, thus indicating that more USD pairs are surpassing their moving average.

A bearish signal is generated whenever the index breaks 75%, thus indicating that more USD pairs are breaking their moving average.

The following shows the evolution of the index versus EURUSD.

🔎 Interpretation 🔎

The index broke 75% in tandem with the market going down (as also shown on the RSI sentiment index). The current configuration still points to more EUR weakness.

Reminder, the following are the results of the strategy so far:

Total hit ratio = 65.21%

Gross profit factor = 2.96

Number of signals = 46

EQUITY RSI SENTIMENT INDEX

The first index uses a formula that involves the relative strength index (RSI) of the totality of the S&P 500’s components. A rule of thumb of this index is to use it as follows:

A bullish signal is generated whenever the index reaches -45%.

A bearish signal is generated whenever the index reaches +45%.

The following shows the evolution of the index versus the S&P 500.

🔎 Interpretation 🔎

The index is neutral at the moment.

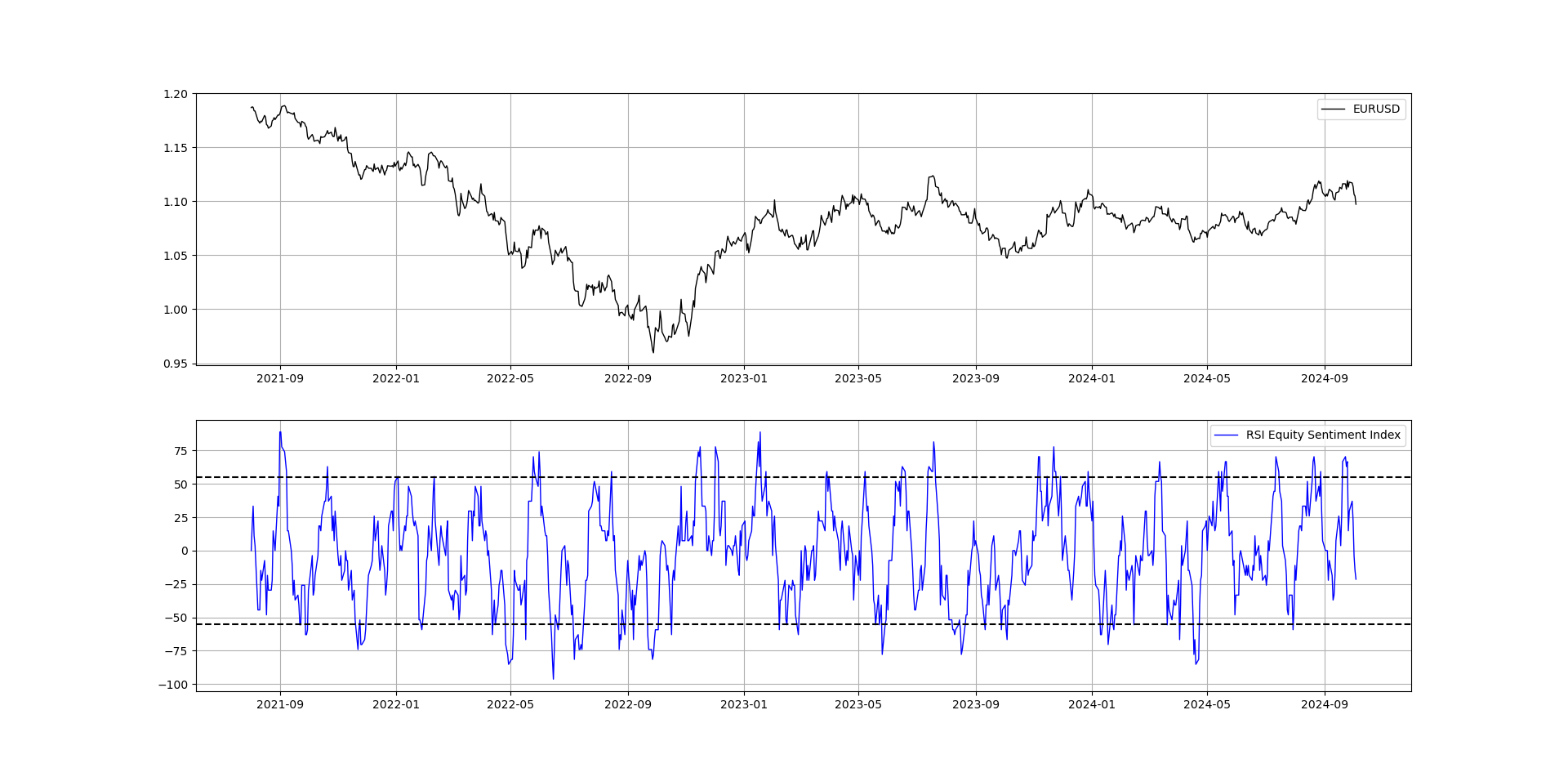

The second index uses a formula that involves the relative strength index (RSI) of the USD major currency pairs. A rule of thumb of this index is to use it as follows:

A bullish signal is generated whenever the index reaches -60%.

A bearish signal is generated whenever the index reaches 60%.

The following shows the evolution of the index versus EURUSD.

🔎 Interpretation 🔎

The index has provided a good bearish opportunity last week. Currently, it’s mostly neutral as it’s in no-man’s land.

EQUITY YEARLY MILESTONE INDEX

This index simply calculates the percentage of stocks in the S&P 500 that are above their close from one year ago.

The following shows the evolution of the index versus the S&P 500.

🔎 Interpretation 🔎

The number of stocks at a 1-year high is above 80% highlighting the strength of the US stock market.

This indicator is non-directional, meaning that it doesn’t predict the direction of the S&P 500, but simply states a fact on the health of the market.

VOLATILITY INDICES

Two volatility indicators are discussed in this section. The CBOE Volatility Index (VIX) is a popular measure of the stock market's expectation and sentiment of volatility implied by S&P 500 index options. It tends to rise when investors expect significant near-term volatility in the stock market. The VIX is calculated using the prices of a wide range of S&P 500 index options. These prices reflect investors' expectations for future volatility over the next 30 days.

Historically, the VIX and the SPX have an inverse relationship. When the SPX declines, the VIX tends to rise, and when the SPX rises, the VIX tends to fall. When the stock market declines, fear and uncertainty increase among investors, leading to higher demand for options to hedge against further declines. This drives up the prices of options, increasing the VIX.

The CBOE EuroCurrency Volatility Index (EUVIX) is a measure of the market's expectations of 30-day volatility of the Euro/U.S. Dollar (EUR/USD) exchange rate. This index is derived from the prices of options on the EUR/USD currency pair and is similar in concept to the VIX (CBOE Volatility Index) which measures the volatility of the S&P 500 index.

The index is calculated using the prices of various options on the EUR/USD currency pair. These options prices reflect the market's consensus on the likelihood of different outcomes for the currency exchange rate.

Technically speaking, the indices have the following technical configurations.

🔎 Interpretation 🔎

On the VIX, the last push-down already started and is still expected to 12.49/11.21. Resistance area remains at 21.60/25.00.

On the FX side, the EUR VIX is still neutral between 14.77/17.59 and 4.72/3.96.

THE AAII INVESTOR SENTIMENT SURVEY

The AAII investor sentiment survey is a weekly survey conducted by the american association of individual investors that measures the mood of individual investors regarding the direction of the stock market over the next six months. Participants are asked whether they are "Bullish," "Bearish," or "Neutral" on the stock market's prospects over the next six months.

💡 Relevant Information 💡

The survey aims to gauge investor sentiment, which can be a useful contrarian indicator. When a high percentage of respondents are bullish, it can indicate market optimism and potentially a market top, while a high percentage of bearish respondents can suggest market pessimism and a potential market bottom.

It is worth mentioning that the AAII survey has a 0.20 correlation with the S&P 500 index, therefore it is weakly correlated to it, and may hint to possible reversals.

The following shows the evolution of the survey.

🔎 Interpretation 🔎

The index is approaching the resistance level but not quite there yet. Reaching it may give a bearish bias on stocks.

THE ISM PMI

The institute for supply management provides a monthly survey called the purchasing manager’s index abbreviated to ISM PMI, which is based on questions asked to 400 representatives of industrial companies about the current and future trend of their different activities. It is composed of 5 components that can also be analyzed individually:

New orders — 30% weight.

Production — 25% weight.

Employment — 20% weight.

Supplier Deliveries — 15% weight.

Inventories — 10% weight.

💡 Relevant Information 💡

Typically, we interpret the index as 50 being the neutral state of the economy (neither growing and neither shrinking). A reading above 50 indicates an expansion in manufacturing and a reading below 50 indicates shrinking in manufacturing.

The following shows the strategy applied on the index.

🔎 Interpretation 🔎

With around 80% of hit ratio, the strategy’s signals are to be taken seriously. Currently, no signal to mention.

If you want to see more of my work, you can visit my website for the books’ catalogue by simply following this link:

THE COT REPORT STRATEGY TRACK RECORD

You will find in this section the details of the previous COT signals from the COT report strategy. Note that this track record is only for illustrative purposes, it is not supposed to attract or solicit any type of action. It is a bookkeeping way of making sure that the techniques used are still delivering value:

All these views can be verified by accessing the previous newsletter in the homepage. The hit ratio is calculated using the directional method. This means that the moment the analysis published, an entry is assumed. If the target has been approached or attained, then the view is recorded as a good forecast. Otherwise, if the market clearly breaks the reaction area (support or resistance), it is recorded as a bad forecast.

Do not hesitate to share your thoughts and forecasts in the comment section.

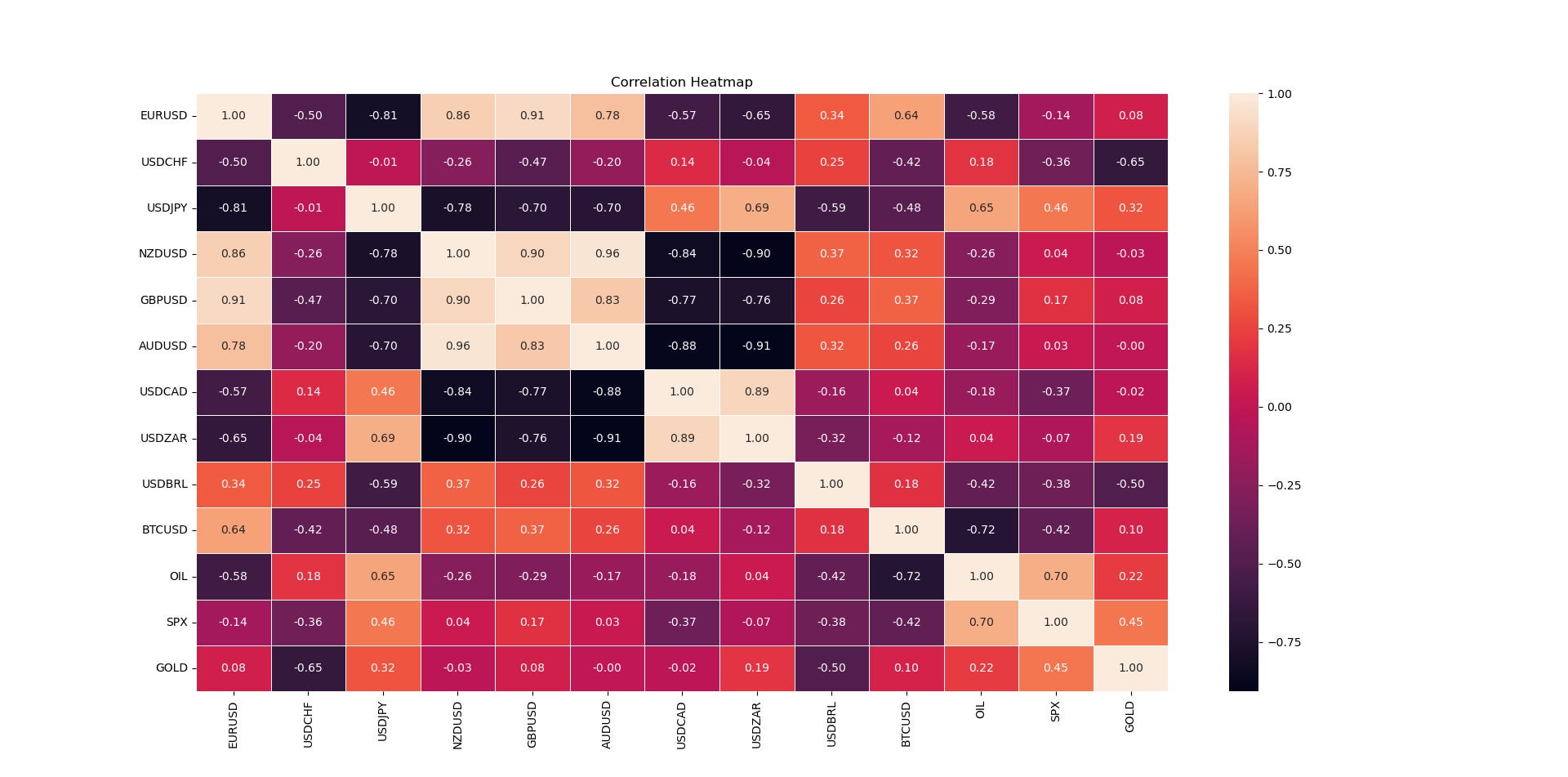

CORRELATION HEATMAP

Correlation is a statistical measure that quantifies the relationship between variables. It measures how closely the returns of two or more assets move together. It ranges from -1 to 1. Understanding the correlations between different markets and asset classes is crucial for managing risk and expectations. The following shows the heatmap between different key markets.

A correlation close to -1.00 implies a negative relationship between the two markets (they move in opposite directions), while a correlation close to 1.00 implies a positive relationship between the two markets (they move in the same direction). Finally, a correlation close to zero implies that there is no linear relationship between the two markets (they may or may not move in the same direction).

RECENTLY CLOSED OPPORTUNITIES

This section highlights the previous charts given from the COT report strategy.

DISCLAIMER

Every information contained in the report is solely for the purpose of showing another angle. Since it is NOT investment advice or trade recommendations, you must NOT use the report as the sole reason for your trading and investing activities.

Trading is fun, enriching, and interesting but not when it comes at the expense of your hard-earned funds. Do not risk what you cannot afford to lose. You must only trade with money you have already considered gone and you must not use trading as your sole revenue generator. Risk management is even more important than the trading strategy itself, make sure to master it.

Data can have many representations and the information presented is but one side of the story which may be incomplete. All back-testing and forward testing results reflect their own time period and not the future as is the case in every research piece.