The Weekly Market Sentiment Report: 16th December - 20th December 2024

The Weekly Market Sentiment Report: 16/12/2024 - 20/12/2024

CONTENTS

EVOLUTION & NATURE OF THE REPORT

ECONOMIC CALENDAR

MARKET SNAPSHOT

SPOTLIGHT

THE COT REPORT STRATEGY

PUT-CALL RATIO SENTIMENT INDEX

THE GAMMA EXPOSURE INDEX

THE MOVING AVERAGE PERCENTAGE INDEX

THE RSI PERCENTAGE INDEX

EQUITY YEARLY MILESTONE INDEX

IMPLIED CORRELATION INDEX 🆕

VOLATILITY INDICES

BOFA HIGH YIELD INDEX 🆕

THE AAII INVESTOR SENTIMENT SURVEY

THE ISM PURCHASING MANAGER’S INDEX (ISM PMI)

THE COT REPORT STRATEGY TRACK RECORD

CORRELATION HEATMAP

CLOSED OPPORTUNITIES

DISCLAIMER

EVOLUTION & NATURE OF THE REPORT

New sentiment models are constantly added while taking into account their overall utility. Feel free to leave a feedback (e.g. nature of the document, its usefulness, its time interval, its content, language, etc.).

The directional views are represented using the following convention and are followed by their charts:

⚡ This symbol represents a new tactical directional opportunity.

🔁 This symbol represents an on-going tactical directional opportunity.

✅ This symbol represents a recently closed tactical opportunity at a profit.

❌ This symbol represents a recently closed tactical opportunity at a loss.

⛓️💥 This symbol represents a neutralized opportunity before seeing its target due to new conflicting technical elements (if the view is neutralized at a loss compared to its entry price, it will be considered as a loss and will have the symbol from the previous step).

The directional views presented must simply be used to help confirm the overall expected direction of the analyzed market. The support and resistance zones are not hard levels, they are merely areas of expected reactions (reversals), and hence for risk management purposes, you are advised to place your stops as you see fit. Some noise may occur around the support and resistance levels.

If you want to see more explanatory details on the report, you can refer to the following post:

ECONOMIC CALENDAR

An economic calendar is a tool used in finance and economics to track and display upcoming economic events, announcements, and indicators that are relevant to the financial markets and the broader economy. The following shows what to expect for the coming week:

MARKET SNAPSHOT

The below table summarizes the weekly changes of some of the key markets:

SPOTLIGHT

The following summarize the key points you need to know for the report:

🗞️ A new sentiment indicator relating to high-yield bonds has been added to this report.

🗞️ The EURUSD moving average percentage index has finally surpassed 25% bullish level, thus confirming a phase of recovery on EURUSD.

🗞️ A new sentiment indicator was released last week and is included in this report. It focuses on correlation from the options market and is used to detect local tops and bottoms on the S&P 500.

🗞️ The number of stocks above their 1-year high continue to plummet.

THE COT REPORT STRATEGY

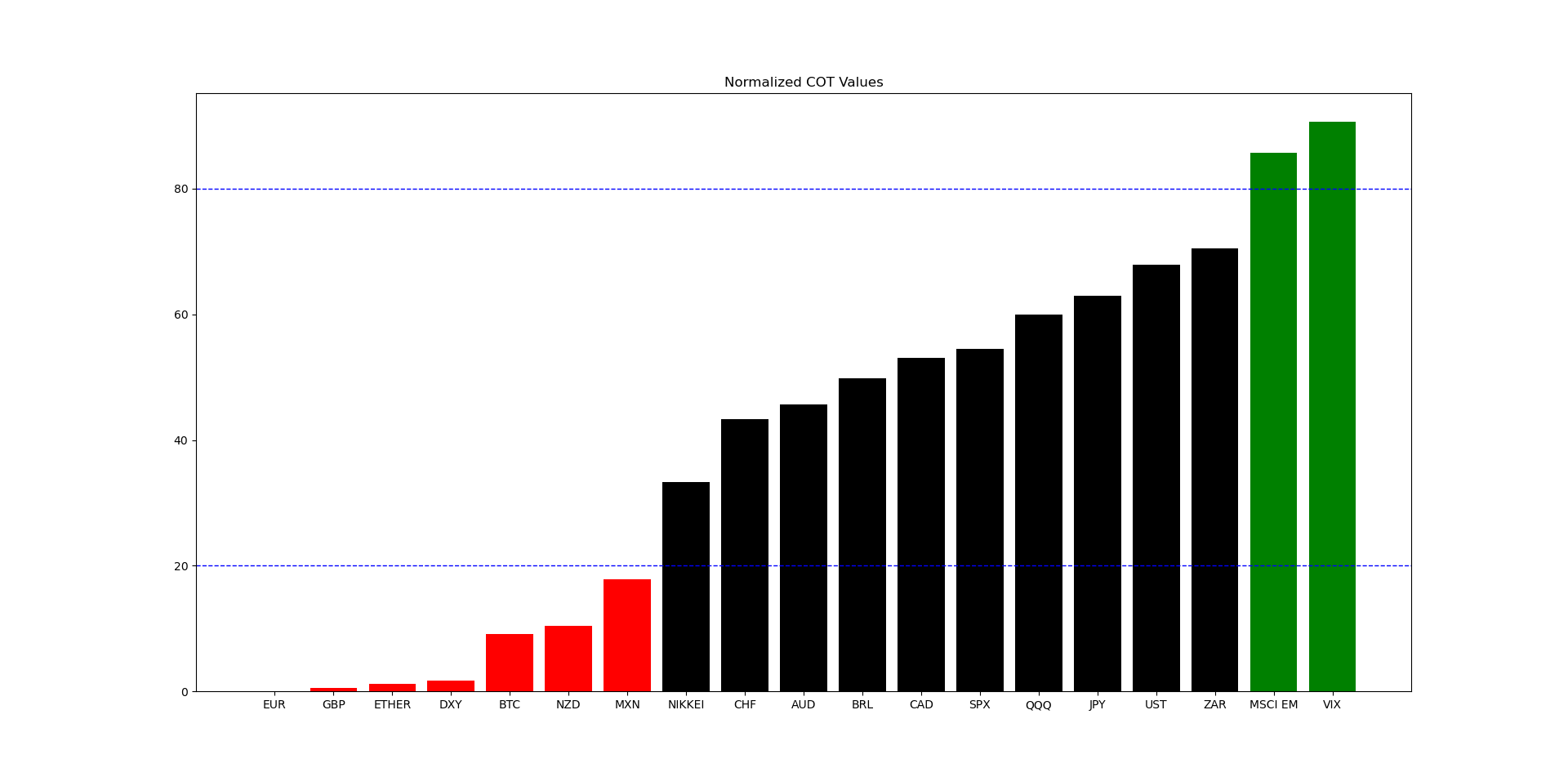

The CFTC publishes statistics of the futures market on a weekly basis called the Commitment of traders (COT) report. The report has many valuable information inside, namely the number of futures contracts held by market participants (hedge funds, banks, producers of commodities, speculators, etc.). Two main categories in the COT report must be distinguished:

Commercial players: They deal in the futures markets for hedging purposes (i.e. to cover their operations or other trading positions). Examples of hedgers include investment banks and agricultural giants. Their positions are negatively correlated with the underlying market.

Non-commercial players: They deal in the futures markets for speculative reasons (i.e. to profit from their positions). Examples of speculators include hedge funds. Their positions are positively correlated with the underlying market.

The COT report strategy is the core of this report. It highlights the markets that are overbought or oversold with regards to sentiment. The following table summarizes the current state of the sentiment for currencies and indices:

Make sure to remember that theses are not advices whatsoever, they are merely charts that fuse sentiment analysis with technical analysis:

⚡ GBPJPY: Bullish reaction expected around 191.50/189.20 to 199.60.

⚡ NZDUSD: Bullish reaction expected around 0.5750/0.5700 to 0.5870.

Keep reading with a 7-day free trial

Subscribe to The Weekly Market Sentiment Report to keep reading this post and get 7 days of free access to the full post archives.